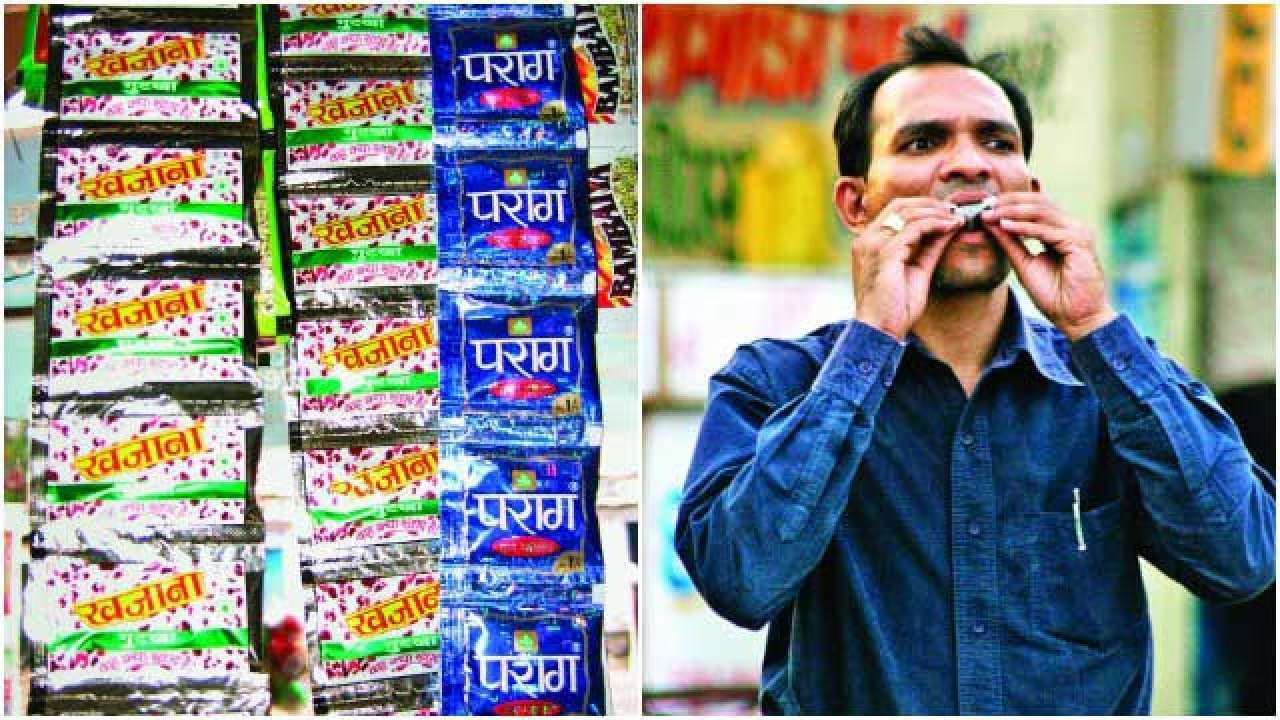

In an effort to curb the health impacts of tobacco consumption, India implemented a ban on gutka—a popular chewable tobacco product—in several states. Despite the ban’s well-intentioned objectives, the policy has faced significant challenges, including the rise of black market trade and considerable revenue losses for both state and central governments. This analysis explores the shortcomings of the gutka ban, its unintended consequences, and the broader implications for public health and governance.

2. The Scope of the Gutka Ban

1. Policy Background:

- Implementation: The gutka ban was first introduced in the early 2000s and has been reinforced through various state-level regulations. The ban is intended to prevent the sale, distribution, and production of gutka, citing its harmful health effects.

- Objective: The primary goal is to reduce tobacco consumption and its associated health risks, including cancer and other diseases.

2. Regulatory Challenges:

- Enforcement Issues: Despite strict regulations, enforcement has been inconsistent. Authorities often face difficulties in monitoring and controlling the widespread production and distribution networks of illegal gutka.

3. Flourishing Black Market

1. Growth of Illegal Trade:

- Market Expansion: The prohibition has inadvertently fueled a robust black market. Estimates suggest that illegal gutka sales constitute a significant portion of the market, with some reports indicating that black market trade could account for up to 70% of the total gutka consumption.

- Distribution Channels: Black market gutka is often sold through unlicensed vendors and underground networks. These channels exploit regulatory loopholes and lack of oversight to reach consumers.

2. Impact on Consumers:

- Product Safety: The quality and safety of black market gutka are unregulated, posing additional health risks. Contaminants and unsafe production practices increase the danger to consumers.

3. Law Enforcement Challenges:

- Resource Constraints: Law enforcement agencies are frequently stretched thin, struggling to combat the extensive black market. The covert nature of illegal trade complicates detection and prosecution efforts.

4. Revenue Losses for Government

1. State Revenue Impact:

- Tax Evasion: The thriving black market undermines tax revenues from the legal tobacco industry. States lose out on significant excise duties and sales taxes that would have been collected from legally regulated gutka.

- Estimates: Financial analyses suggest that states could be losing billions annually due to tax evasion and the shift to black market products. For instance, Karnataka, one of the states with a gutka ban, reportedly experienced a decline in revenue by approximately ₹1,000 crore.

2. Central Government Revenue Impact:

- Reduced Tax Collection: The central government also faces revenue shortfalls due to decreased tax collections from the tobacco sector. This reduction impacts overall budgetary allocations and fiscal planning.

3. Economic Ripple Effects:

- Business Impact: Legal businesses involved in the production and sale of gutka face reduced market share, which affects their profitability and employment levels. This economic downturn further impacts tax revenue and job creation.

5. Lessons and Policy Implications

1. Reevaluation of Ban Effectiveness:

- Policy Review: The failure to curtail gutka consumption through a ban suggests the need for a reevaluation of the strategy. Instead of outright bans, a more nuanced approach involving regulation and harm reduction could be more effective.

2. Strengthening Enforcement:

- Resource Allocation: Enhanced funding and resources for enforcement agencies are crucial. Improved monitoring and stricter penalties for illegal trade could help curb the black market.

3. Public Health Strategies:

- Education and Awareness: Comprehensive public health campaigns focusing on education about the dangers of tobacco and promoting alternatives can complement regulatory measures.

- Support Systems: Providing support for addiction cessation and implementing harm reduction strategies can also contribute to reducing tobacco consumption.

4. Taxation and Regulation:

- Revised Tax Policies: Revisiting taxation policies to strike a balance between discouraging consumption and ensuring revenue generation could help address the financial shortfall.

- Regulatory Framework: Creating a robust regulatory framework for the legal tobacco industry could minimize black market activities and increase government revenue.

Conclusion

The gutka ban in India, while aimed at addressing public health concerns, has highlighted significant shortcomings in policy execution. The proliferation of black market trade and substantial revenue losses underscore the need for a more effective approach. By reassessing regulatory strategies and strengthening enforcement, India can better address the challenges of tobacco control while mitigating economic impacts and improving public health outcomes.