In India, where financial security is a top priority, many individuals seek reliable investment options. The National Savings Certificate (NSC), a government-backed savings scheme, has emerged as a popular choice for risk-averse investors seeking guaranteed returns and tax benefits. This article delves into the advantages of NSCs, exploring how they can contribute to your financial goals.

The Hallmark of Security: Government Backing and Guaranteed Returns

Unlike market-linked investments that fluctuate with economic conditions, NSCs offer a sense of security due to their government backing. Issued by the Government of India, NSCs come with a sovereign guarantee, meaning the principal amount invested is guaranteed by the government. This provides peace of mind, knowing your investment is safe from market volatility.

Fixed Interest Rates and Compounding Benefits

NSCs offer fixed interest rates set by the government every quarter. While these rates may not be the highest compared to some other investment options, they provide a predictable and guaranteed return on your investment. Furthermore, the interest earned on NSCs is compounded annually, meaning the interest earned is reinvested and earns interest itself, leading to a snowball effect and potentially higher returns over the long term.

Tax Benefits: Saving Money While Saving on Taxes

One of the most attractive features of NSCs is their tax benefits. The amount invested in NSCs qualifies for a tax deduction under Section 80C of the Income Tax Act, up to a maximum limit per financial year. This allows you to reduce your taxable income, potentially lowering your tax liability. Additionally, the interest earned on NSCs is generally not taxable if the investment is held until maturity.

Flexibility in Investment Tenure:

NSCs offer a range of investment tenures, typically ranging from 1 to 10 years. This flexibility allows you to align your investment horizon with your financial goals. Whether you’re saving for a short-term objective like a down payment on a vehicle or a long-term goal like retirement, an NSC tenure can be chosen to suit your needs.

Liquidity Options: Premature Closure with Minimal Penalty

While NSCs are meant to be long-term investments, they offer some degree of liquidity. In case of unforeseen circumstances, you can prematurely close your NSC after a specific lock-in period (typically 1 year) with a penalty on the interest earned. This provides some flexibility in case of emergencies.

Convenience and Easy Investment:

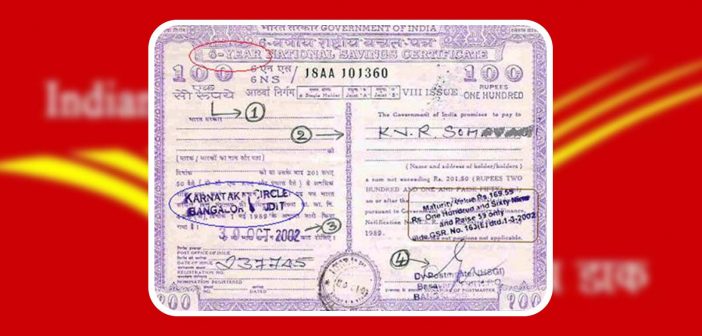

Investing in NSCs is a convenient and straightforward process. They can be purchased at post offices across the country, eliminating the need to open a demat account or navigate complex investment procedures. The minimum investment amount is relatively low, making NSCs accessible to a broad range of investors, even those with limited savings.

Building a Secure Financial Future:

NSCs are a valuable tool for planning your financial future. Here’s how they can contribute to your financial well-being:

Retirement Planning: Long-term NSC investments can provide a steady stream of income after retirement.

Child’s Education: NSCs can be a reliable way to save for your child’s future educational needs.

Building an Emergency Fund: NSCs, with their premature closure option, can contribute to an emergency fund for unexpected financial situations.

Beyond the Advantages: Considerations for NSC Investment

While NSCs offer a plethora of benefits, there are some factors to consider before investing:

Lower Returns Compared to Some Investment Options: NSCs might not offer the highest returns compared to stock market investments or mutual funds. However, they prioritize security over high returns.

Limited Liquidity: NSCs are not as liquid as some other investment options. Premature closure comes with a penalty, and early access to your principal might not be ideal for all situations.

Tax Implications After Maturity: While the interest earned on NSCs enjoys tax benefits during the investment period, the interest earned in the final year is taxable if the investment matures after a specific period.

Conclusion: A Balanced Approach to Savings

NSCs cater to a specific segment of investors prioritizing security and guaranteed returns over potentially higher, but market-linked, yields. They offer a unique combination of government backing, tax benefits, and flexibility in terms of tenure, making them a valuable tool for building a secure financial future. However, a balanced approach to savings is crucial. Consider NSCs alongside other investment options based on your risk tolerance and financial goals.