NSDL Payments Bank, an arm of the National Securities Depository Ltd. (NSDL), was launched with high expectations in India’s burgeoning digital payments landscape. Despite NSDL’s established reputation in financial services, the payments bank has faced significant challenges in gaining traction. Launched in 2018 after receiving approval from the Reserve Bank of India (RBI) in 2015, the bank aimed to capitalize on India’s push for financial inclusion and digitization. However, several key hurdles have hindered its progress, raising questions about its future prospects.

Backing and Initial Optimism

NSDL’s entry into the payments banking sector was seen as a natural extension of its existing infrastructure, with its established credibility in managing depository services for the Indian capital market. The institution’s strong financial base, experienced leadership, and potential synergies with NSDL’s existing services provided a foundation that many expected would lead to quick success in the competitive payments market.

The initial strategy was to integrate NSDL Payments Bank into India’s rapidly growing digital payments ecosystem. Targeting the large base of retail and institutional investors using NSDL services, the payments bank intended to provide seamless banking, especially focusing on areas such as remittances, low-value payments, and financial inclusion(.

Hurdles and Lack of Differentiation

Despite the optimism surrounding its launch, NSDL Payments Bank has faced multiple challenges in scaling its operations and attracting a substantial user base. One key issue has been its inability to distinguish itself from competitors. Payment banks such as Paytm and Airtel Payments Bank have leveraged aggressive marketing strategies, broader retail networks, and strong digital platforms to capture market share, leaving NSDL Payments Bank struggling to compete.

Another hurdle is the niche focus of NSDL’s existing customer base. NSDL primarily deals with investors and institutional clients, but expanding its services to a broader retail market has proven difficult. Unlike competitors that operate in mass-market segments with large user bases, NSDL’s focus on securities-related services and financial markets has limited its ability to penetrate rural and underbanked regions, key targets for payment banks..

Limited Physical Presence and Digital Footprint

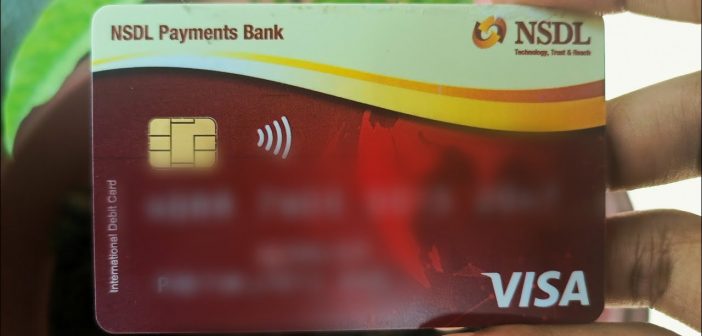

Moreover, NSDL Payments Bank’s limited physical and digital presence has slowed down its adoption. Other payment banks have quickly built vast networks of retail outlets or partnered with existing businesses to boost their footprint across the country. NSDL Payments Bank, by contrast, has focused primarily on digital channels, but without the same level of penetration or public visibility that more prominent fintech players have achieved.

Additionally, the bank has struggled to offer competitive products and incentives. Other payment banks have introduced features such as cashback, rewards, and promotions, making them attractive to price-sensitive consumers. NSDL Payments Bank’s offerings, by comparison, have lacked the aggressive customer acquisition tactics needed to compete in a space dominated by well-funded players.

Financial Struggles and Market Conditions

According to financial reports, the bank has seen a decline in performance metrics like EBITDA (down by 41.43% in FY 2018), while its operating revenue remained under INR 1 crore, suggesting sluggish growthThese figures highlight that despite its potential, the bank has been unable to scale at a pace that aligns with market expectations, compounded by high competition and a lack of a clear niche or differentiation.

Conclusion

While NSDL Payments Bank continues to operate and has strong financial backing from its parent organization, its lack of competitive differentiation, limited visibility, and inability to appeal to a mass-market audience have stunted its growth. Unless NSDL Payments Bank can pivot its strategy, innovate its service offerings, and boost its physical and digital presence, it risks falling further behind in an intensely competitive sector.

The challenges faced by NSDL Payments Bank underscore the difficulties of navigating India’s highly competitive and rapidly evolving digital payments landscape, even with a solid financial foundation.