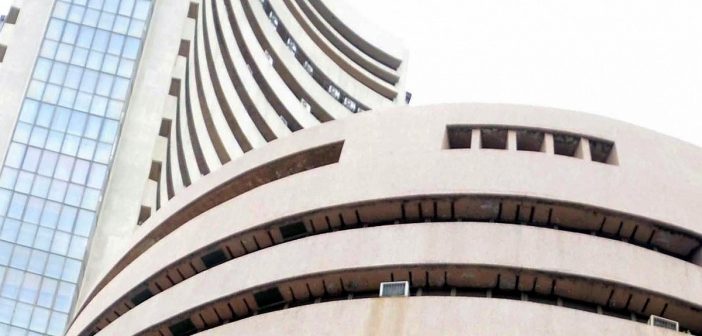

The Indian stock markets—NSE and BSE—have continued to fall for the second consecutive week beginning October 7, 2024, with a mix of global and domestic factors contributing to the sell-off. Here’s a breakdown of the major factors driving the downturn and what it means for small investors and traders.

Key Factors Behind the Fall:

- Global Economic Uncertainty: A significant driver of market weakness is the broader global economic situation. The ongoing Israel-Iran conflict has created geopolitical instability, leading to market jitters globally. Additionally, persistent concerns about U.S. inflation and future interest rate hikes by the Federal Reserve have discouraged investor sentiment, creating sell-offs in emerging markets like India(.

- Foreign Institutional Investors (FIIs) Selling: Heavy selling by foreign investors has added to the pressure on Indian equity markets. In the past week alone, FIIs sold approximately ₹40,509 crores worth of Indian equities, targeting cheaper alternatives in other markets such as China and Hong Kong. Large-cap stocks, especially index heavyweights like Reliance Industries and HDFC Bank, have borne the brunt of this selling, dragging down the indices further.Sector-Wide Decline: Most sectors are trading in the red, with particularly sharp corrections in sectors like metal, real estate, and banking. The Nifty Metal index dropped over 2%, while the broader BSE SmallCap index plunged by nearly 4%. This widespread correction is largely due to overvaluation concerns that have persisted since mid-2024, coupled with the sell-off of global equities(.

- U.S. Economic Data Impact: Stronger-than-expected U.S. nonfarm payroll data, released last week, has raised fears that the Federal Reserve may delay interest rate cuts, which could keep borrowing costs higher globally. This has further affected market sentiment in India, contributing to the slide in domestic equities(.Technical Weakness: Analysts are pointing to an approaching support zone for the Nifty 50 around the 24,800 mark. If this level is breached, the index could dip further into oversold territory. However, this presents an opportunity for long-term investors as a market rebound is expected once the index hits key support levels.

Impact on Small Investors and Traders:

- Increased Volatility: Small investors should brace for heightened volatility in the coming weeks. With FIIs continuing to exit and domestic markets reacting to global cues, there may be further downside risks, especially for small and midcap stocks, which are particularly vulnerable during corrections.

- Opportunities for Value Investors: For long-term investors, this downturn could present a buying opportunity, particularly in quality large-cap stocks that have been dragged down by the broader market correction. Domestic institutional investors (DIIs) are expected to continue purchasing undervalued stocks, potentially stabilizing the market in the medium term.

- Risk of Overexposure: Traders heavily invested in small and midcap stocks should reconsider their positions as these segments are expected to underperform relative to large caps over the next few months. Historically, smallcaps tend to underperform after a rally, and with market valuations correcting, further dips in these stocks could lead to significant portfolio erosion(.Safe-Haven Assets: Investors are shifting toward safe-haven assets like gold amid market uncertainty. Diversifying portfolios to include such assets could help small investors hedge against potential losses in equities.

Conclusion:

The second consecutive week of declines in NSE and BSE highlights the risks tied to global uncertainty and FII selling. While volatility may persist in the short term, long-term investors can take advantage of lower valuations. Small investors should stay cautious, avoid overexposure to smallcaps, and consider portfolio diversification to mitigate risks during this period of market turbulence.