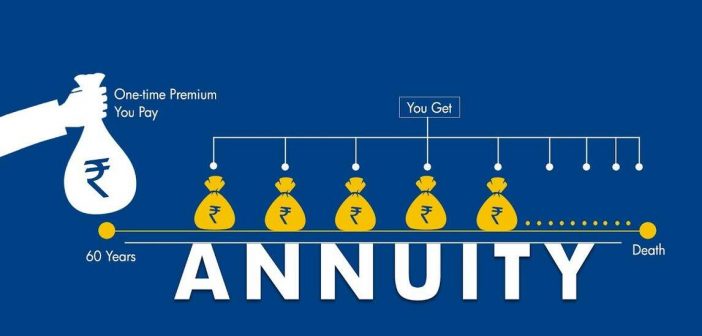

Despite their global popularity as a cornerstone of retirement planning, annuities remain underutilized in India. This reluctance to invest in annuities, a financial product that provides a steady income stream during retirement, can be attributed to a mix of cultural preferences, lack of awareness, and concerns about flexibility and returns. However, the consequences of this trend could be significant for Indian retirees, who might miss out on the financial security that annuities can offer.

Market Landscape and Trends

Globally, the annuities market has been growing, with the U.S. seeing a 22% increase in sales in 2022, reaching around $310 billion. This growth is driven by increasing life expectancies and market volatility, which have made the guaranteed income from annuities more attractive to retirees. In contrast, the annuity market in India remains relatively small, with insurance companies struggling to push these products amid strong competition from more familiar options like fixed deposits and provident funds.

Cultural and Behavioral Barriers

Indians traditionally favor investments that offer immediate liquidity and guaranteed returns, such as fixed deposits, gold, and real estate. Annuities, which typically require a lump-sum investment and provide returns over time, are perceived as less attractive due to their long-term nature. This preference for liquidity and immediate returns is a significant barrier to the adoption of annuities.

Moreover, financial illiteracy plays a crucial role. Many Indian investors are unfamiliar with how annuities work and the benefits they can offer, leading to a lack of trust in these products. The Indian market is also characterized by a conservative approach to retirement planning, with a strong preference for risk-free investments, despite the potential for higher returns from more diversified portfolios.

What Indians Are Missing Out On

The reluctance to invest in annuities could lead to a lack of financial security in retirement. Annuities offer several benefits that are particularly valuable in the Indian context, where the social safety net is limited:

- Guaranteed Income: Annuities provide a reliable income stream, ensuring that retirees do not outlive their savings, which is increasingly important as life expectancy rises.

- Protection Against Market Volatility: Unlike equity-based investments, annuities are not subject to market fluctuations, making them a stable source of income.

- Tax Benefits: Some annuity plans offer tax advantages under Indian law, which can enhance their attractiveness as a retirement investment.

Conclusion

While annuities might not be the go-to investment for most Indians, the benefits they offer in terms of financial security and protection against longevity risk are compelling. For those looking to build a robust retirement plan, incorporating annuities could be a prudent strategy. However, this will require a shift in investor mindset, better financial education, and possibly policy incentives to encourage greater adoption of annuities in India.

By avoiding annuities, Indian investors may be missing out on a vital tool for securing their financial future, particularly in an era of increasing life expectancy and economic uncertainty.